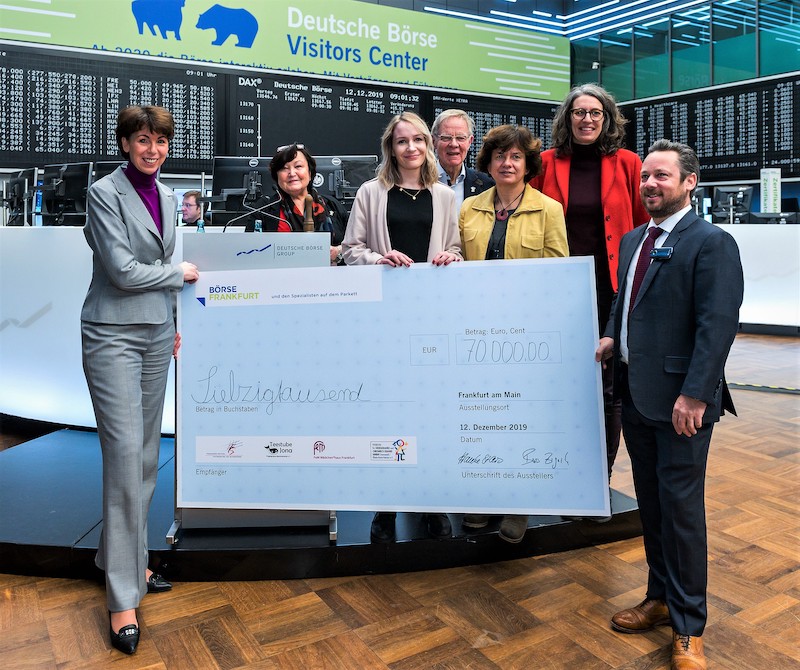

Bankhaus Scheich as well as the securities trading banks (‘specialists’) operating on the Frankfurt Stock Exchange floor and Deutsche Börse AG donated the sum of 70,000 Euro to this year’s Trading Charity, which is distributed among four charitable institutions.

The donation amount derives from the transaction and trading fees received on St. Nicholas’ Day through the Frankfurt Stock Exchange. Investors trading shares, bonds, funds, ETFs, ETCs or ETNs on the Frankfurt Stock Exchange on 6 December therefore supported all institutions simultaneously.

Bankhaus Scheich supports the roadshow activities of ABO Wind AG

The 3% convertible bond 18/20 of ABO Wind AG, which was placed with private investors by the company itself in 2018 and with institutional investors in 2019 with the support of Bankhaus Scheich, was converted in a quantity of 425,193 at the end of the conversion window in October 2019. This corresponds to a conversion rate of more than 50%. At the same time, the company’s equity was strengthened by around 6.4 million Euro. The number of shares in ABO Wind AG therefore increased by 425,193 to the present total of 8,070,893 shares. The non-converted bonds are due for repayment in May 2020. Bankhaus Scheich supports the company on an ongoing basis in all capital market issues, including roadshow activities to broaden capital market transparency and improve the trading liquidity of the ABO share.

Bankhaus Scheich acts as selling agent for the successful new issue of Deutsche Rohstoff AG

Bankhaus Scheich has significantly supported the successful placement of the new corporate bond of Deutsche Rohstoff AG as selling agent. The new bond has a coupon of 5.25% and a 5-year maturity. Thanks to strong demand from domestic and foreign institutional investors, the bond has reached a volume of 87.1 million Euro. The placement was preceded by an international roadshow in Luxembourg, Switzerland and London, among other locations. Deutsche Rohstoff AG is now able to use the funds raised to pursue its chosen path of growth consequently over the coming years.